Restructured Financing

Financing with another bank

Once the financial model is created, we now understand the mathematics of operations and can predict cash flow with reasonable accuracy. Now, we can work on the balance sheet. The three areas we focus in on here is:

- Debt service coverage

- Liquidity (Working capital approach)

- Leverage (Collateral analysis approach)

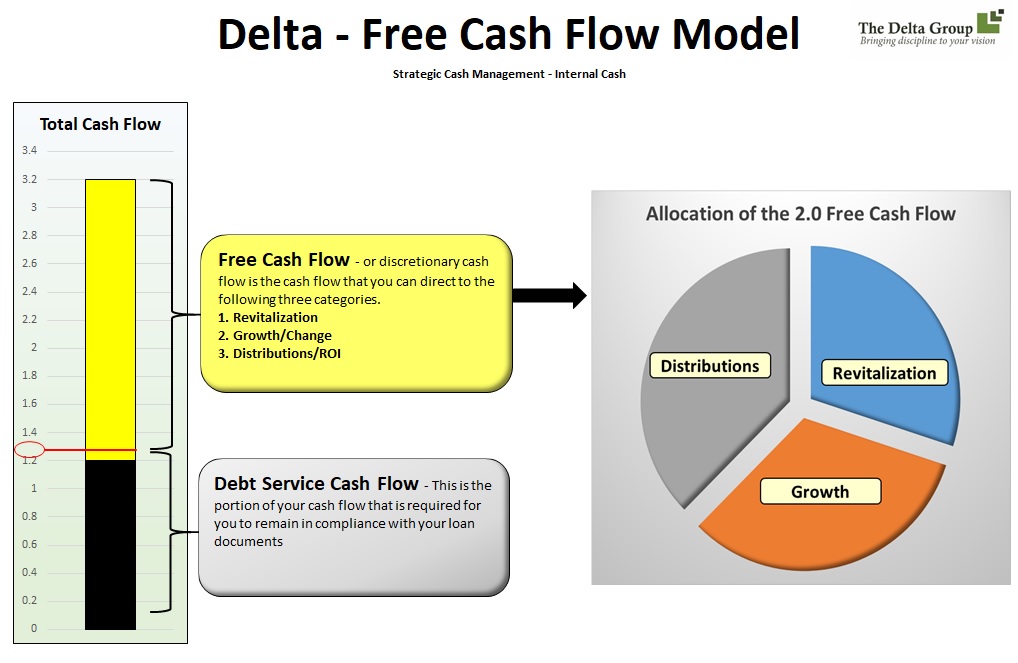

Debt Service Coverage

The financial model has defined the cash flow that is available on a monthly basis. Now, this needs to be put in perspective to the company needs. Your bank needs to know that the company is generating enough cash flow to pay the debt back with interest. To measure this, the bank will compare the cash flow generated from operations on an annual basis to the annual debt service. The bank uses a debt service coverage (DSC) ratio to track the company’s performance. The debt service coverage ratio is calculated as follows:

So, the formula is a comparison of cash flow to debt payments. A bank will usually require a DSC ratio of 1.2 to 1. This means that the bank will require the company to generate $120 of cash flow for every $100 of debt service.

The DSC ratio is usually measured annually but it can also be measured quarterly, monthly or on a rolling four quarters or rolling twelve months. Failure to meet the DSC ratio requirements is a default. A DSC ratio default is no different than payment default. Both allow the bank to exercise its rights and take action.

Liquidity (working capital ratio)

Liquidity is a measure of a company’s ability to pay its bills as they become due. To measure this, a bank uses a current ratio.

Current assets are those assets that will turn into cash in the next twelve months. Current liabilities are those liabilities that need to be paid in the next twelve months. If the current assets are less than the current liabilities, then it’s likely that the company does not have the ability to pay its debts unless it gets cash flow from operations or from the sale of fixed or other assets. You can also change this ratio by lowering the current liabilities. Terming out a current liability (making a plan to pay a current liability in more than twelve months) can improve the ratio to an acceptable level.

A working capital ratio is expressed in term of a comparison such as 1.2 to 1. In this case, the company has $120 of current assets for every $100 of current liabilities. It’s common for a bank to require a working capital ratio of 1.1 to 1, but never lower than 1.0 to 1. A working capital ratio may be a requirement in the loan documents, or it could just be something they look at internally to measure the company’s performance.

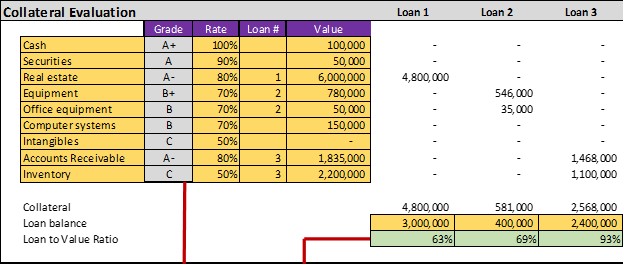

Leverage (collateral analysis approach)

When cash flow fails, collateral is considered a second form of payment. The problem is, not all collateral is of equal quality. If a bank has to rely on the collateral as payment, there are expenses that a bank will incur in turning those assets into cash. For example, a bank may sell an asset at auction, a piece of real estate for example. If the real estate was originally appraised for $1 million, it might only sell for $800k. then the auction process will cost 10% or $80k. That leaves a net of $720k for the bank to satisfy the loan. A bank will likely limit a real estate loan to 80% of appraised value. If so, the bank will lend up to $800k on this real estate appraised at $1 million. A $800k loan with a $720k recovery means that the bank will take a $80k loss on this auction, not a good deal for the bank.

The analysis below is an excerpt from one of our models. Each asset is listed, the grade (quality), and the lending rate.

In this example, real estate has a quality grade of “A-“ which means it is a desirable asset for collateral. The lending rate on this asset is 80%, which is the most that can be borrowed against this asset. It the real estate is appraised at $6 million, the borrowing limit is $4.8 million ($6 million x 80%).

Now, we compare the loan limit of $4.8 million with the actual loan balance of $3.0 million, which is a 63% utilization of the lending capacity.

The loan to value ratio is 50%, computed as follows.

Leverage (debt to equity approach)

The debt to equity is another approach used to measure leverage. Lenders like to see a ratio that is 3 to 1 or less. They may extend to 6 to 1 a long is there is a plan to get it below 3 to 1. A typical debt to equity ratio will be computed as follows.

If you can imagine two identical companies with a different funding structure, the balance sheets and debt to equity ratios would look like the following.

A debt to equity ratio is a measure of the extent to which a company is financing its operations through debt versus internal funds.

If a lot of debt is used to finance growth, a company could potentially generate more earnings than it would have without that financing. If leverage increases earnings by a greater amount than the debt’s cost (interest), then shareholders should expect to benefit. However, if the cost of debt financing outweighs the increased income generated, share values may decline. The cost of debt can vary with market conditions. Thus, unprofitable borrowing may not be apparent at first.

Building A Restructuring Plan

These ratios are key to any debt restructuring. The company is in distress because it has failed these, or other important ratios that the bank identifies as key to a company’s success. Now, the company has to prove that it will be able to meet these ratios going forward. To be convinced of this, a bank needs to see the following in a plan and projected financial statements.

- What changes that are going to be made and the dollar value impact of the changes?

- How will these changes affect the balance sheet and income statement going forward?

- How will these changes affect the key ratios going forward?

- How long will it take for the company to return to normal operating levels in the key financial ratios.

This is your roadmap to success. When a bank restructures the company’s debt based on a plan that contains the components listed above, they are going to measure your actual financial performance against the projections described above to make sure the plan is achievable. Your requirement is to make sure the company meets or exceeds the requirements set out in the restructuring plan.

Click here to see how the Delta Group's improved reporting system prevents this from happening again.